An ambitious yet strategic energy transition is going to be key in safeguarding the Latin America and the Caribbean (LAC) region’s long-term economic development from the damaging effects of the region’s emissions.

The instability of an economy overly reliant on fossil fuels, as well as the cross-industry damaging effects of climate-change-induced pollution could further inequalities and inhibit economic growth. By adopting active fiscal policies on decarbonisation, electrification, and renewable generation, the LAC region can enhance its economic resilience to the effects of climate change, as well as create new jobs through the transition.

The Renewables in Latin America and the Caribbean initiative established a regional target of 70% renewable energy by 2030, with individual commitments made by 15 LAC country signatories.

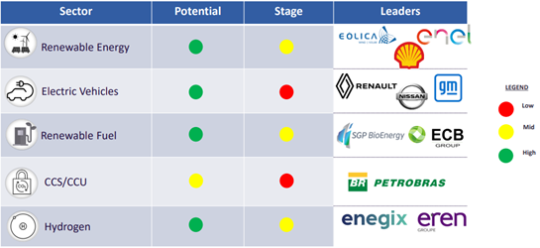

Rates of renewable generation vary greatly across the LAC region, which is making strides in the early phases of its energy transition. Sectors such as hydrogen and renewable energy and renewable fuels are moderately developed, albeit with significant remaining untapped potential to be targeted over the coming years, while the electric vehicles (EV) and carbon capture, utilisation, and storage sectors (CCUS) are still at low stages of development.

Much of the renewable generation is attributed to large-scale hydropower plants. Hydropower is the largest contributor to the LAC region’s power capacity and is expected to maintain this status. However, its contributions will likely stabilise, slowing down to contribute 35% of the region’s power output in 2035. Renewable power capacity will increase strongly, with growth sectors, including solar photovoltaic expected to grow with a compound annual growth rate (CAGR) of 11.2 between 2023 and 2035.

Incited by a surge in energy demands to replace the decrease in thermal power generation, coal and gas are expected to have net growth rates of 0.6% and 2.6% respectively, despite a decreasing contribution to the LAC power generation share. Overall, the increase in renewable power capacity will be driven by correlating increases in cost-effectiveness. However, these increases will be curbed by the challenges of renewable intermittency.

The adoption of EVs across the Mercosur region is lagging significantly behind the global average and as such the LAC region accounts for a mere 0.1% of the global EV market. However, several governments in the LAC region have laid out action plans to bolster EV adoption, such as Ecuador’s mandate that all public transport vehicles must be electric from 2025.

Private industry production is also likely to accelerate in response to increased consumer demands, contributing to an expected decrease in the gap between LAC EV adoption and the global average. The renewable fuel supply in the LAC is set to increase strongly over the coming decade, with the commission of new refineries bolstering renewable fuel supply at an expected CAGR of 59% between 2020 and 2030. Brazil, already a global leader in biofuel production, is predicted to increase its stronghold on ethanol production, reaching one-third of the global market by 2040.

Continued growth in sustainable aviation fuel (SAF) is unlikely to keep pace with growth in the region’s SAF demand and SAF production growth in other regions, meaning that the region will transition from a net SAF exporter to a net SAF importer.

Development in the CCUS sector has stalled. Analysis of the filing analytics for major LAC oil and gas companies shows considerable internal discussion of CCUS technologies, indicating an awareness of the potential that the CCUS sector has to decarbonise its own operations. Uptake in the CCUS sector likely must be preceded by pressure to accelerate and adhere to government low-carbon initiatives rather than relying on lethargic private interests. Hydrogen capacity within LAC is expected to undergo rapid growth, sustained by the objective of hydrogen fuel exportation from the LAC region to North America, Europe, and Asia.

Development in the production and adoption of hydrogen fuel is supported largely by ambitious national hydrogen strategies, which lay out goals for the market development, exportation and contributions of green hydrogen across the LAC region. These goals are geographically specific, taking advantage of each country’s unique position such as Colombia’s Caribbean and Pacific ports, and Paraguay’s large surplus of hydroelectricity.

Estimates of the LAC low carbon hydrogen capacity growth between 2020 and 2030 range between reaching 2.2 and 3.6mtpa capacity by 2030, dependent on the completion rates of post-feasibility and pre-feasibility project stages. Reaching the high target of 3.6mtpa by 2030 will be contingent upon the continued growth of the global hydrogen market and increased financial support, both of which have optimistic outlooks.

The growth of the low carbon hydrogen capacity will have primary end-use sector applications in transportation, which will maximally experience the advantage of hydrogen’s high energy density relative to electrification, as this is key for the feasibility of decarbonised fuel supply for larger and long-distance vehicles. While energy transition is necessary for LAC’s economic development, the strategy upon which it will be founded will not be simple.

These policy strategies must walk a fine line between the ambition needed to mitigate the effects of climate change and the necessary caution to avoid exacerbating existing fiscal concerns such as mounting public debt and inflation. The energy transition has the potential to create jobs in emerging sectors and this must be done in tandem with the scaling down of high-carbon industries, so as not to further inequality of opportunity.

The next strides for energy transition in the LAC region

The renewable fuel supply in the LAC is set to increase strongly over the coming decade.