GlobalData’s latest report, ‘Malaysia Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of Malaysia and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

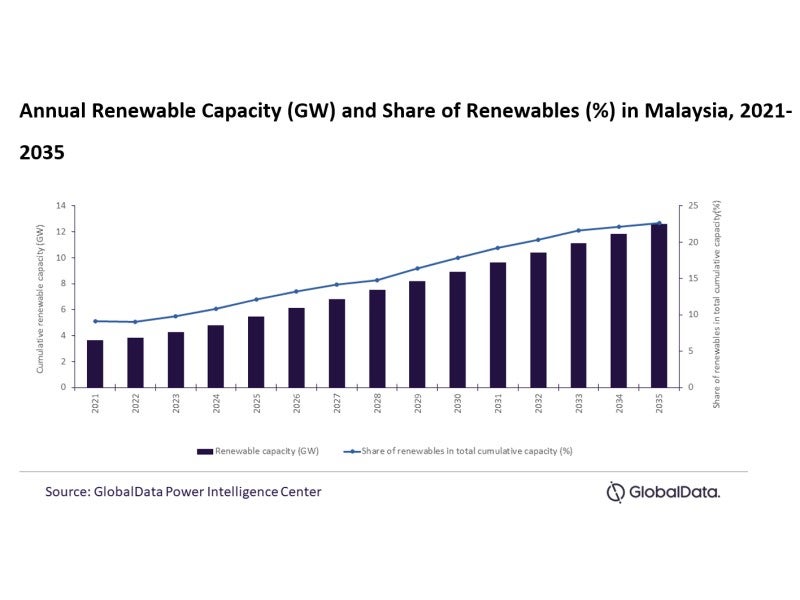

In 2021, the Ministry of Energy and Natural Resources of Malaysia (KeTSA) set a target to achieve 31% renewable capacity by 2025 and 40% by 2035. Later in the National Energy Policy (2022-2040) the government set a target to achieve 18.4GW renewable capacity by 2040. Both objectives are highly unrealistic, as only 9.1% of the country’s total capacity is accounted for by renewables. According to the current growth trend, Malaysia is expected to achieve only 12.1% renewable capacity by 2025 and 22.7% by 2035, moreover, by 2040 the renewable capacity is expected to reach only 16GW, falling short of its target due to the absence of robust policy support.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSolar PV, biopower and small hydro are the only three renewable sources utilised by the country. In 2015, Malaysia took a step towards exploring geothermal power by launching the 30MW Tawau project, which was later abandoned, as there were no obvious signs of activity detected. Also, the country has only one small onshore wind plant with a capacity of 0.2MW. The growth of wind power projects has been hindered by low wind speeds during off seasons, however, several small wind projects could still make a difference.

The government has implemented feed-in tariffs (FiT) (for up to 1MW capacity) and net metering policies in place to encourage the adoption of renewable energy. But there are no major incentives or support for large-scale renewable projects. The government has struggled to attract investment in large-scale renewable projects due to sluggish economy. It has failed to implement robust policies that curtail the development of fossil-based power capacity and encourage renewable power capacity.

In 2021, thermal power accounted for almost 75.8% of the total cumulative capacity in Malaysia and is expected to account for 63.5% in 2035. Gas-based thermal power will continue to be a crucial element of the country’s electricity mix, whereas coal-based generation will see a drastic reduction.

To achieve its climate goals, Malaysia should look to create partnerships to enable technology transfer to improve efficiency of renewable power plants. A detailed policy with a clear roadmap with strict implementation measures is required for renewables growth. The government can look to offer incentives and tax breaks to bring in private and foreign investments, which will help regain confidence after the 1Malaysia Development Berhad (1MDB) scandal.

The country has well-developed solar module production facilities, but it should seek to exploit this and create a strong value chain. It also needs to explore untapped wind and geothermal potential.

Malaysia’s GDP (at constant prices) increased from $255bn in 2010 to $388.2bn in 2021, at a CAGR of 3.9%. GDP declined by -5.6% in 2020 from 2019. In 2021 the GDP grew marginally by 3.1% after the resumption of trade activities. Between 2021 and 2030, the economy is expected to grow at a CAGR of 4.1%, reaching $557.6bn in 2030.