Hydrocarbons will continue to form the backbone of Middle Eastern economies

The Middle East’s energy transition continues to be slow and piecemeal, despite promises of large additions of renewable capacity in the coming years, the region still remains highly dependent on its fossil fuel reserves. In 2022, thermal power (coal, oil, and gas) accounted for 90% of the region’s power capacity. Although this power capacity share is expected to decrease, fossil fuels will continue to dominate, with GlobalData forecasting that by 2035, thermal power will still account for 70% of total capacity. A similar story emerges in the power generation mix, with fossil fuels being expected to account for 84% of the power generation mix in 2035.

This data is unsurprising, given that the region contains some of the largest fossil fuel reserves in the world. Saudi Arabia alone accounts for 17.5% of global oil reserves according to the World Population Review, with several other Middle Eastern countries also featuring in the top ten for global oil reserves. Overall, the region accounts for roughly 20% of natural gas supply and 30% of the world’s supply of crude oil. As a result of its rich reserves, hydrocarbon fuels form an essential element of the Middle East’s economy at both the domestic and international levels, with the energy sector accounting for over 3,400 jobs in 2019, and with the region acting as a key exporter of oil products to the rest of world.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReports

Middle East Energy Transition Market Analysis by Sectors (Power, Electrical Vehicles, Renewable Fuels, Hydrogen and CCS/CCU) and Trends

Like the rest of the world, the Middle East has set bold renewable energy targets

The Middle East’s reliance on its fossil fuels starkly contrasts its ambitious renewable energy targets, with the United Arab Emirates (UAE) targeting a renewable energy generation of 44% by 2050. Some countries in the region have also set ambitious nearer-term targets. Saudi Arabia has the most ambitious target, aiming for 50% of total generation by 2030. Meanwhile, Oman aims to achieve 30% renewable generation by 2030, while Qatar’s target is 20% in the same year. The Middle East plans to bolster its renewable generation primarily through solar and wind power. These two forms of renewable energy are particularly appealing due to the natural climatic conditions prevalent throughout the Middle East, as well as the falling cost of producing energy through these two processes. Over the last decade the cost of generating electricity from wind and solar has fallen by 70%, and 80% respectively, and is forecast to continue falling by another 11% and 30% by 2030.

The increasing cost-effectiveness of wind and solar energy will lead to a growth in generation from these two sources within the Middle East. Both solar PV generation and wind energy will experience strong growth, increasing at CAGRs of 15.8% and 15.9% between 2023 and 2035, respectively. In the solar market, this growth will be driven by the capacity additions from state-owned companies such as Abu Dhabi Power Corp, which has an active capacity of over 1,120MW and a further 4,900MW in the pipeline. In the wind sector, state-owned Saudi Procurement Co has 1,800MW in the pipeline, making it the largest wind energy player in the Middle East by a significant stretch. However, active capacity across solar and especially wind remains relatively small. As a result, the strong growth of these two renewable energy sources will not guarantee the Middle East’s overall decarbonisation.

The Middle East’s renewable energy targets risk becoming just hot air

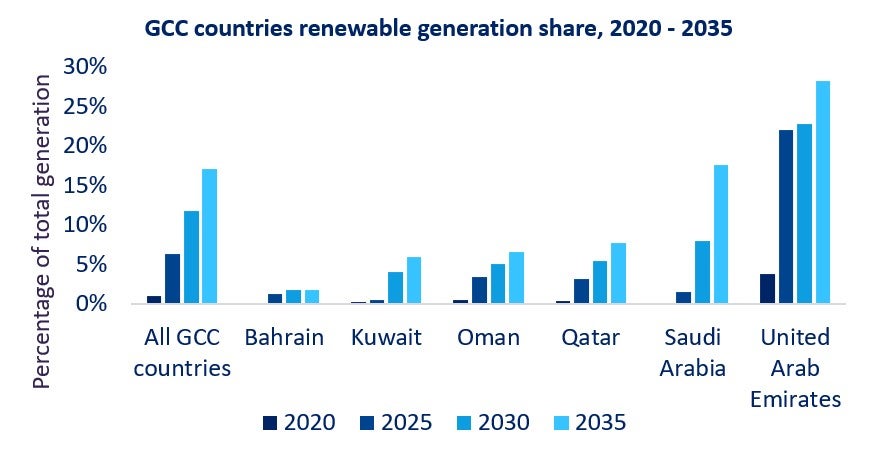

Despite ambitious renewable energy targets and an increasing number of solar and wind projects in the pipeline, renewable generation is forecast to account for a mere 8.3% of the total generation mix by 2030. Although this will grow to 11.7% by 2035, the region, for now, will remain reliant on its oil and gas reserves. At the national level, performance between countries on their renewable generation share differs significantly. For example, the UAE is expected to reach a renewable generation share of 28% by 2035, which would represent substantial headway towards its 44% by 2050 target. However, some countries’ renewable targets continue to remain aspirational. Although Saudi Arabia has the most ambitious renewable energy target, active and upcoming renewable energy projects will create a renewable generation share of less than 8% in 2030 and 15% by 2035, this represents a large undershoot of its target. Although the Middle East has experienced an increase in demand for its oil exports due to geopolitical fallout in the wake of the Russia-Ukraine conflict, demand for fossil fuel resources is expected to steeply decline in the coming decades.

The Middle East’s over-reliance on oil products to support its economy will be undermined by falling global demand for oil exports. As well as endangering climate targets, the Middle East currently runs the risk of stranded assets and a retreat from the world stage if it fails to adapt to trends in energy market headwinds. While there is an increasing business case for renewable generation and countries in the Middle East have piled on the bandwagon of bold renewable energy targets with the rest of the world, the danger of these targets becoming an empty promise remains real.