The outbreak of Covid-19 has caused significant disruptions to markets around the world, including the US and has prompted the US Senate to pass a $2.2tn emergency relief package, aimed at boosting its floundering market. Despite being an advanced economy, the US is susceptible to global disturbances, as their economy is largely service-oriented that in turn is dependent on commodities produced in developing nations such as China, India, and other Asian countries. Covid-19 has substantially dented manufacturing capacity in China, an integral player in the global supply chain, resulting in a slowdown in commercial activity for several large US companies dependent on Chinese supplies. As the outbreak continues to spread, changes in consumer behaviour are expected, which is likely to stem the country’s economic growth. What is more, solar module prices are already being affected.

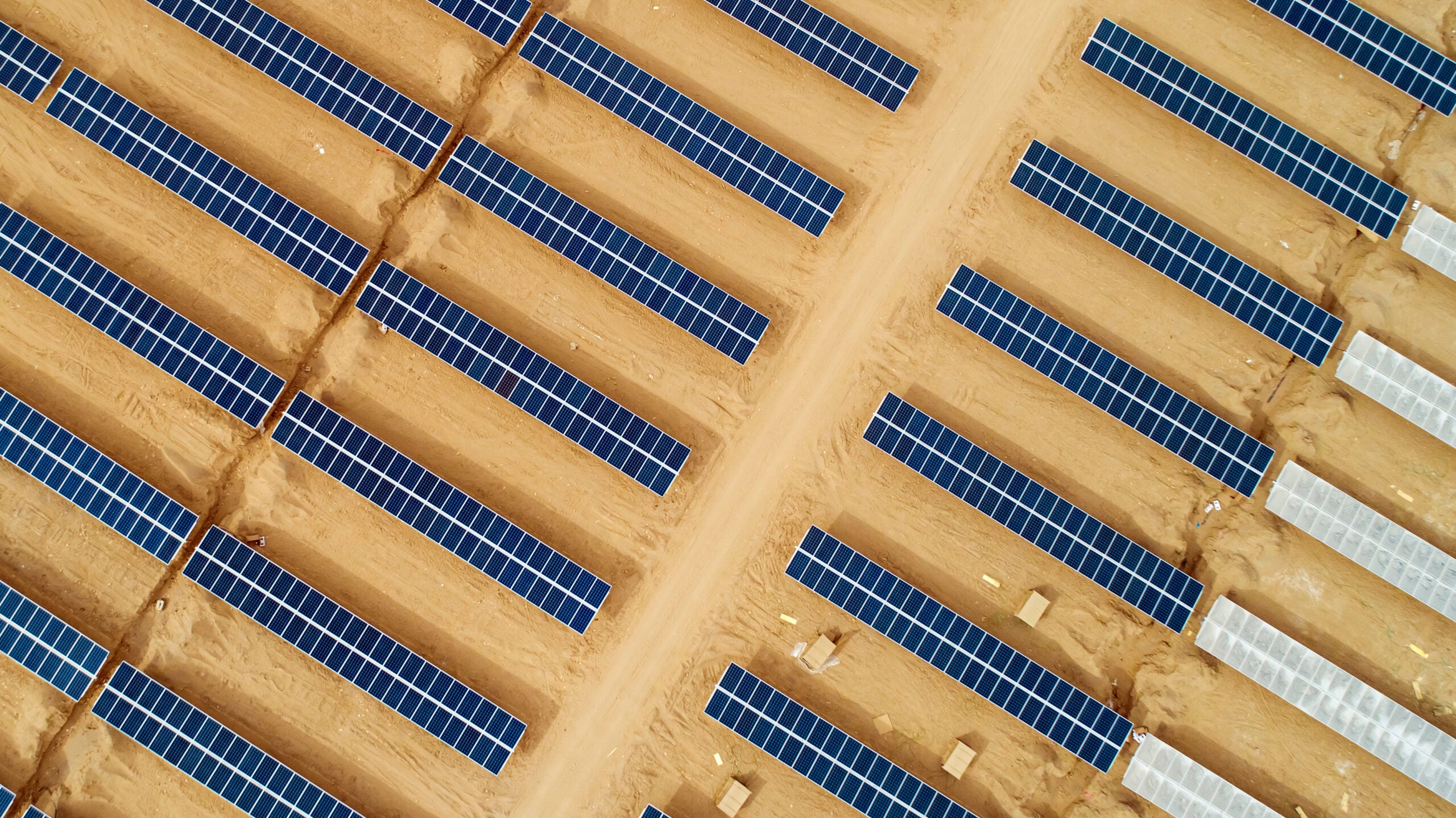

In particular, the US energy industry has been vulnerable to the global disruptions. Plunge in fuel prices, reduction in global demand, and price war between Saudi Arabia and Russia have delivered a severe blow for the oil and gas industry; despite best efforts by the government to open new markets such as China, India, and the UK, to support its large production output that has exceeded domestic demand. Similarly, since 2018, the renewables sector has continued to suffer, with the introduction of tariffs on imported equipment, which dramatically raised the cost of solar module prices. Nevertheless, solar continues to be cost-competitive and is one of the cheapest forms of power generation in the country. In 2019, solar emerged the nation’s top power source but now faces uncertain times, due to the ongoing Covid-19 crisis. The Solar Energy Industries Agency (SEIA) predicts that nearly 50% of the workforce employed in the solar industry could be without jobs, as solar companies are likely to face significant headwinds in procuring capital to fund projects. Moreover, several projects under-development and construction could fail to qualify for subsidies due to manufacturing and shipping delays that can add to a developer’s woe.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe implementation of tariffs has resulted in relatively high module prices but the sustained market growth of solar is a result of continued support from state governments. Between quarter 4 (Q4) in 2019 and Q4 in 2020, module prices were likely to decline by 15.6%, as per previous estimates. However, with the sudden upheaval in the market due to the Covid-19 outbreak, the price decline is expected to slow-down to 4% between Q4 in 2019 and Q4 in 2020. A surge in price is likely to be prominent in Q2, with the price diverging by 15.3%, in comparison to Q2 estimates prior to the outbreak. The trend is expected to continue in Q3 and Q4, with the price likely to be 12.7% and 13.7% higher respectively, post-outbreak.

Developers not only face component supply disruptions such as panels and inverters, but also labour shortages; as quarantine measures are being implemented to stymie Covid-19 transmission. The shortage of labour and equipments is not only confined to the US market but also in other prominent solar markets across the world. Since the initial implementation of tariffs in 2012, the US has slowly diversified its panels procurement base to move away from being overly reliant on China to Malaysia, South Korea, and Vietnam amongst others. However, with the pandemic impacting the aforementioned countries as well, prices are expected to increase, due to various afflictions impacting their respective markets.

During Q1, the price is estimated to rise to $0.37/W, with Covid-19 market implications becoming more notable. By Q2 and Q3, the associated effects are likely to become more distinct and the price in Q2 is estimated to reach $0.378/W. In Q3, although a decline is expected, prices will remain relatively high, as a number of developers with “harboured” projects are likely to be driving the demand in a slowly recovering supply market. In 2018, the announcement of a periodic phaseout of the Investment Tax Credit (ITC) incentive, prompted significant solar capacity development, which enabled developers to avail the availability of higher tax credits than the lower credits in subsequent years. By the end of Q4, the market is expected to have stabilised and the price is expected to decline to $0.345/W.

The US solar industry is facing several challenges, induced by the Covid-19 outbreak that threaten the survival of various businesses and developers within the market. With challenges in procuring equipment and labour shortages, companies with “harboured” projects would face a great deal of inconvenience, increasing their exposure to risks and liabilities. Moving forward, the federal government could provide aid in the form of loans or grants and extend the federal Investment Tax Credit, and increase the flexibility around meeting legal requirements, which would greatly benefit the solar industry.

Related Company Profiles

SEIA Co., Ltd.