GlobalData’s latest report, ‘United Kingdom Power Market Outlook to 2035, Update 2022 – Market Trends, Regulations, and Competitive Landscape’, discusses the power market structure of the UK and provides historical and forecast numbers for capacity, generation and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

As a result of Brexit and its reliance on imports from the common EU market, the UK is now facing questions regarding higher energy prices and an unreliable supply of electricity. To combat this, the government needs to make substantial investments to meet more of its electricity demands by using renewable sources.

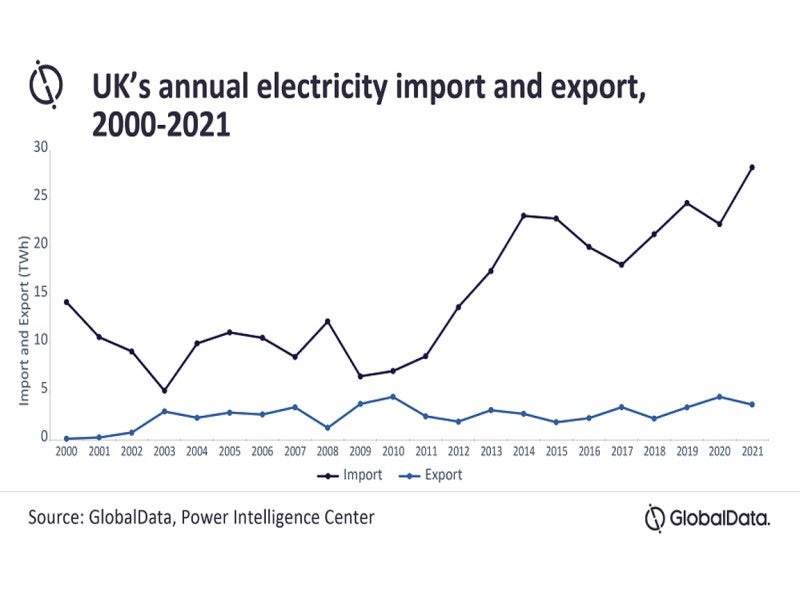

The UK generates power from a diverse range of sources, including coal, gas, oil, hydropower, renewables and nuclear power. Thermal power is its main source of power generation and gas-fired power plants constitute most of its thermal capacity. The UK is actively involved in power exchanges with several European countries, although in more recent years this has been characterised by a rather unsteady power import pattern.

The recent Russia-Ukraine conflict raised questions on the reliability of imports. Although the UK does not rely heavily on Russia for its gas imports, it is not immune to the high prices caused by the conflict. Moreover, the UK has imposed sanctions on Russia, which will leave a gap that renewables will most likely fill. According to the UK’s Energy and Climate Intelligence Unit (ECIU), the energy bills in the country could rise to £2,520 (€3,000) in October 2022, a £505 (€600) increase from previously expected levels as an impact of the Russia-Ukraine crisis.

The UK Government is committed to increasing the share of renewables in its energy mix and is introducing new policies and partnering up with private entities to drive the growth of renewable power in the electricity sector. In 2021, renewable power generation held a 39.4% share in the total power generation of the country, increasing from a 6.2% share in 2010. The introduction of the Smart Export Guarantee (SEG) and plans to increase renewable power capacity are also expected to create more opportunities in this sector.

Recently, 1,300 trillion cubic feet of shale gas reserves were discovered in the north of England. Before this happened, it had been estimated that shale gas would constitute 76% of the UK’s energy imports in 2030, but following the discovery of the gas reserves, this was revised to 37%. Shale gas is expected to extend the UK’s natural energy supply by 50 to 100 years at the current consumption rate. The shale gas industry is currently in the beginning stages in the UK, and the government is preparing tax breaks and incentives to attract investment in this sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe UK is one of the leading European economies and, along with Germany and France, has spearheaded economic growth in Europe. The key drivers of the UK’s GDP growth have been services (chiefly banking), insurance and business services. GDP rose from $2,481.6bn in 2010 to $2,843.4bn in 2021 at a CAGR of 1.2% (constant rates). The UK economy took a hit during the pandemic, with GDP declining by 9.7% in 2020 from 2019. Backed by several funding programmes from the government, the economy revived, with the GDP growing by 7.5% in 2021 from 2020, with all the above rates being at constant rates. GDP is expected to reach pre-pandemic levels between 2022 and 2023.