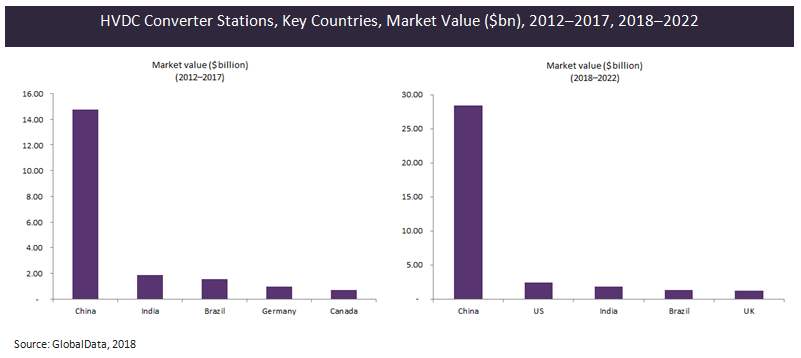

The global high-voltage direct current (HVDC) converter station market held an aggregate value of $26.86 billion during the period 2012–2017.

According to GlobalData’s latest report HVDC Converter Stations, Update 2018 – Global Market Size, Competitive Landscape, Key Country Analysis, and Forecast to 2022, with increased investor confidence and improving global economic conditions, the market is expected to show considerable growth in the future and is expected to hold an aggregate market value of $51.34 billion during the period 2018–2022. This growth is expected to be driven by China, the US, India, Brazil, the UK, and Germany, which together will account for more than half of the global market share during this period.

HVDC technology is shaping the grid of the future by acting as a key enabler in the modern energy system. The need for high-voltage and long distance power lines for transmission of bulk power from remote generation, and for integration of renewable energy capacity with the main grid, will accelerate the demand for HVDC converter stations globally. Renewable energy is becoming a major source for power generation worldwide to bridge the gap between the capacity potential and electricity generated. Supportive government policies, major renewable energy initiatives, and favorable financial measures – such as the EU’s energy targets to achieve 30% renewable electricity, Brazil’s Program of Incentives for Alternative Electricity Sources (PROINFA), India’s 175 gigawatt (GW) renewable energy auctions by 2020, and Germany’s Renewable Energy Sources Act, 2017 – are driving the growth of renewable energy. Countries such as Canada, Brazil, China, and Norway have huge hydropower potential. The hydropower plants have to be sited where the hydrology is feasible, which is usually far from urban demand centres. The integration of alternative energy sources will accelerate the need for HVDC transmission lines which will drive the HVDC converter station market. HVDC technology is ideally suited for the efficient transmission of power from such remote plants to urban centres.

In 2017, the HVDC converter station market was dominated by five major players together holding 83% of the global market namely, Swiss manufacturer ABB Ltd, German manufacturer Siemens AG, China-based XJ Group, French-based Grid Solutions, Inc., and Indian manufacturer Bharat Heavy Electricals Ltd. The increased demand for power, cross-border power transmission, the various global initiatives taken to encourage implementation of renewable smart grids, and the need to restrict carbon emissions globally will boost the HVDC market, thereby driving the HVDC converter station market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAccording to the report, China led the global HVDC converter station market in the historical period holding an aggregate market value of $14.79 billion between 2012 and 2017. In 2004, China started investing in ultrahigh-voltage (UHV) transmission, as the sites of its energy resources were far away from the southern and eastern load centres, and UHV transmission was a logical choice for keeping transmission and distribution (T&D) losses low over long distances. There is an increased focus on cross-border interconnection and renewable energy, and many projects are being planned for development in the forecast period. China’s State Grid Corporation of China (SGCC) estimated investment of $36.5 billion for UHV expansion during its 13th Five-Year Plan (FYP) period (2016–2020). India ranked second, next to China, in the global HVDC converter station market, with an aggregate market value of $1.88 billion during the historical period (2012–2017). The significant rise in renewable energy generation, supported by the government’s objectives, has driven the HVDC converter station market in India, due to the need to transfer electricity from the widely scattered renewable energy generating sources to load centres. The increased necessity for HVDC converter stations created a huge market in Brazil, and it was ranked third in the historical period with an aggregate market value of $1.52m. Most of the country’s generation capacity is located far from urban demand centres

During the forecast period (2018–2022), China is expected to continue to hold its leading position followed by the US and India. The rising electricity demand in various countries across the globe is prompting investment in the electricity networks, and the governments of various countries are establishing key initiatives to promote investment in the transmission network, such as EIPC, Energy Policy Act of 2005, Renewable Portfolio Standards (RPS), the Federal Transmission Pricing Policy, and promoting smart grid development under the American Recovery and Reinvestment Act. These initiatives are expected to keep the market demand for HVDC converter stations stable through the forecast period.