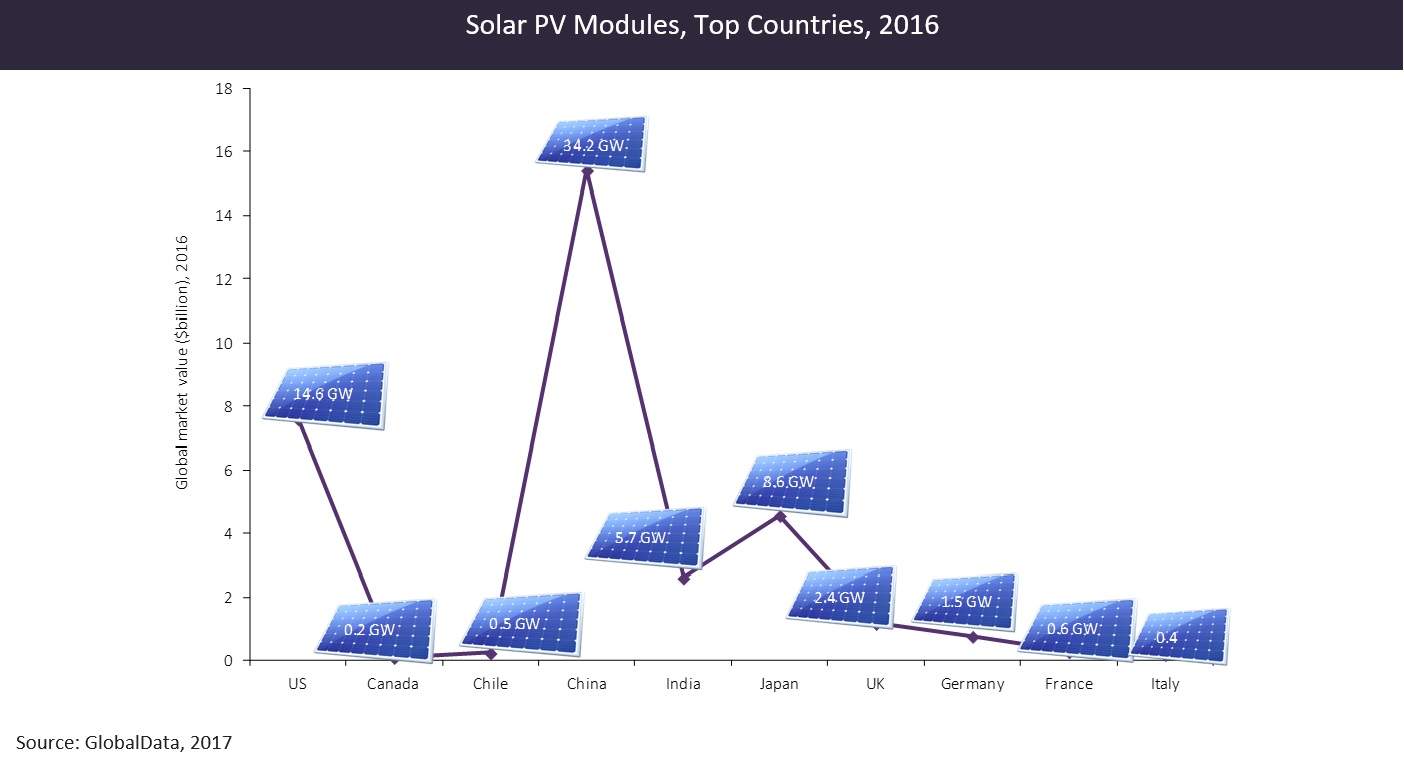

The global solar photovoltaic (PV) modules market was valued at $36.69bn in 2016 and is estimated to reach $22.72bn in 2021. According to GlobalData’s latest report Solar PV Modules, Update 2017 – Global Market Size, Competitive Landscape, Key Country Analysis, and Forecast to 2021, for the fourth consecutive year, Asia eclipsed all other markets, accounting for about two-thirds of global additions. The top five markets – China, the US, Japan, India, and the UK – together contributed approximately 95% of the market value in 2016. Though China continued to dominate both the use and manufacturing of solar PV, emerging markets on all continents have begun to contribute significantly to global growth.

The fall in the market value was mainly due to the fall in module prices. The reduction in module price was attributed to the excess production by silicon manufacturers. On the flip side, the reduction in module prices resulted in an increase in the installed capacity in 2016 and is estimated to remain stable through the forecast period. The total installed capacity between 2017 and 2021 is estimated to be close to 380 gigawatts (GW), whereas it stood at approximately 262GW between 2011 and 2016. China, Japan, and the US led the global solar PV module market during the year 2016. The market developments in the top countries are largely due to the economies of scale, emerging technologies, and policy-based government and industrial institutions.

The PV modules prices are estimated to further decline during the forecast period due to competitive market conditions. With minimal price differences between module suppliers, buyers are price sensitive, thus creating persistent price pressure. Furthermore, module prices have declined for a variety of reasons, including but not limited to, the anti-dumping tariffs implemented by the US on Chinese modules, the euro and yen depreciation, and the downward adjustment of the minimum import prices.

During the forecast period, on average, close to 75GW are expected to be developed year-on-year. The market expansion was largely due to the increasing competitiveness of solar PV, as well as to rising demand for electricity and improving awareness of solar PV’s potential as countries seek to alleviate pollution and reduce CO2 emissions.

The global solar module manufacturing market is highly fragmented with the majority being c-Si module manufacturers. The reason could be attributed to its mature technology and lower investment cost. The trend observed in the market is that c-Si module manufacturers manufacture the modules and purchase cells as a raw material from other manufacturers. This enables them to keep the cost low. The thin-film market, however, has fewer manufacturers as it is a second-generation solar PV and the technology is in its nascent stage. In the c-Si module market, JinkoSolar Holding Co., Trina Solar, Canadian Solar, JA Solar Holdings Co., Ltd., Hanwha Q Cells GmbH, and GCL System Integration Technology Co. were the largest manufacturers in 2016. The thin-film module market was largely dominated by a US-based manufacturer, First Solar and by Solar Frontier, a Japanese company.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

According to the report, the Asia-Pacific region held approximately 67% of the market during the year 2016, followed by the Americas with 22%, and Europe, Middle East, and Africa (EMEA) with 11%. The Asia-Pacific region is expected to lead the global market at the end of the forecast period. China, India, and Japan were the top countries in the region and held approximately 70.6% of the global market share in 2016 with respect to installed capacity.