The global wind power market size increased from $24.3 billion in 2006 to $103.8 billion in 2016 at a CAGR of 15.6%. A major boost in investment is expected due to an increase in the capacity installations, led by countries such as China, the US, Germany and India, as well as emerging countries in the Asia-Pacific, Middle East and Africa (MEA) area, and the South and Central America (SCA) regions. During 2017–2025, the wind power market size is expected to increase from $104.6 billion to $111.4 billion as per GlobalData’s recent report on the global wind power market.

The desire for clean, reliable, and affordable power is the foremost factor for wind power market growth. Governments worldwide are investing in wind power to ensure stability and security of clean energy. The regulatory framework and policy structure supporting wind power in various regions and countries has led to significant development in the global wind power industry, and has driven the leading wind power nations in growth trajectories. In the wake of growing energy security, a decrease carbon emissions, and an increase the power supply, most countries are expected to strengthen their wind power support mechanisms, which will help the global wind power industry to maintain growth in the coming years.

The following figure illustrates the global wind power market size during the 2006–2025 period.

Until 2016, global offshore wind accounted for less than 5% of annual capacity additions each year and was 3.1% in 2016. Higher turbine running times, high logistics costs, and a lack of skilled manpower combine to make offshore wind service more challenging. This scenario is expected to change during 2017–2025 with more offshore capacity expected to be added in the UK, Germany, the US and China. The share of offshore capacity additions is set to rise to 12.3% in 2020, and offshore installations are expected to contribute a share of 14.5% capacity additions during 2020–2025. By the end of 2025, 76 GW of offshore wind power is set to be operational and represents a 7.4% share of the cumulative wind power capacity in that year compared with the current 2.8% share.

Asia-Pacific is the largest wind power market, accounting for a share of 43.6% of the global cumulative installed capacity in 2016. Governments in this region are strongly committed to having a cleaner energy mix to increase the power supply, a decrease in carbon emissions, and achieving higher electrification rates in remote areas. APAC is followed by Europe and North America, with a share of 32.9% and 19.8% in the same year, while South and Central America, and the Middle East and Africa had small shares of less than 3% each. In terms of annual capacity additions in 2016, the regions fared in the same pattern as that of cumulative capacity, with the Asia-Pacific region installing more than half of all capacity added in 2016.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

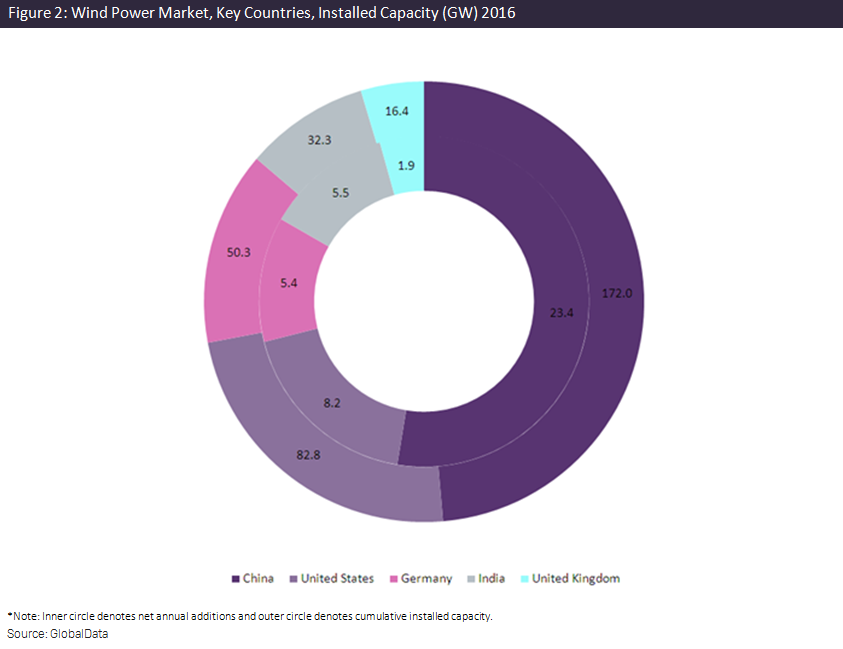

By GlobalDataChina with around 34.6% of total capacity additions is the global leader in terms of capacity additions; with this share the country reached 172 GW cumulative installations mark as of 2016. The country had exceptionally good capacity additions during 2009–2011 and also in 2015 and 2016. In China, various government measures have supported the development of wind technology, including the Riding the Wind Program (1996), the Wind Power Concession Program (2002), reduced VAT and income tax relief (2002) for renewable energy, Wind Power Construction Administration (2005), Law on Renewable Energy (2006), and Offshore Wind Development Plan (2009). This has led to development in the wind manufacturing sector and joint ventures for adopting the emerging technologies and increasing the size of wind turbines.

In 2016, US had the second largest market after China with a share of 14.2% in terms of annual installed capacity. The country added 8.2 GW of the annual capacity in the same year. The US is followed by Germany with the addition of 5.4 GW of the annual capacity in 2016. The US and Germany have had large capacities since the early 2000s and both have excelled in terms of wind power technology and achieving better efficiencies. It was only in 2009 and 2010 that China overtook Germany and the US, respectively, in terms of installed capacity. The wind power market growth in the US is influenced by concerns for carbon emissions, which are supported by financial incentives and policies like renewable portfolio standards, federal and production tax credits.

The following figure illustrates the key countries wind power installed capacity in 2016.