China-based JinkoSolar Holding was the leading company for global solar photovoltaic (PV) module shipments in 2018.

The company had shipments of 9.7 GW of PV modules compared to Trina Solar’s 9.1 GW, keeping its rival in second place, according to GlobalData.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

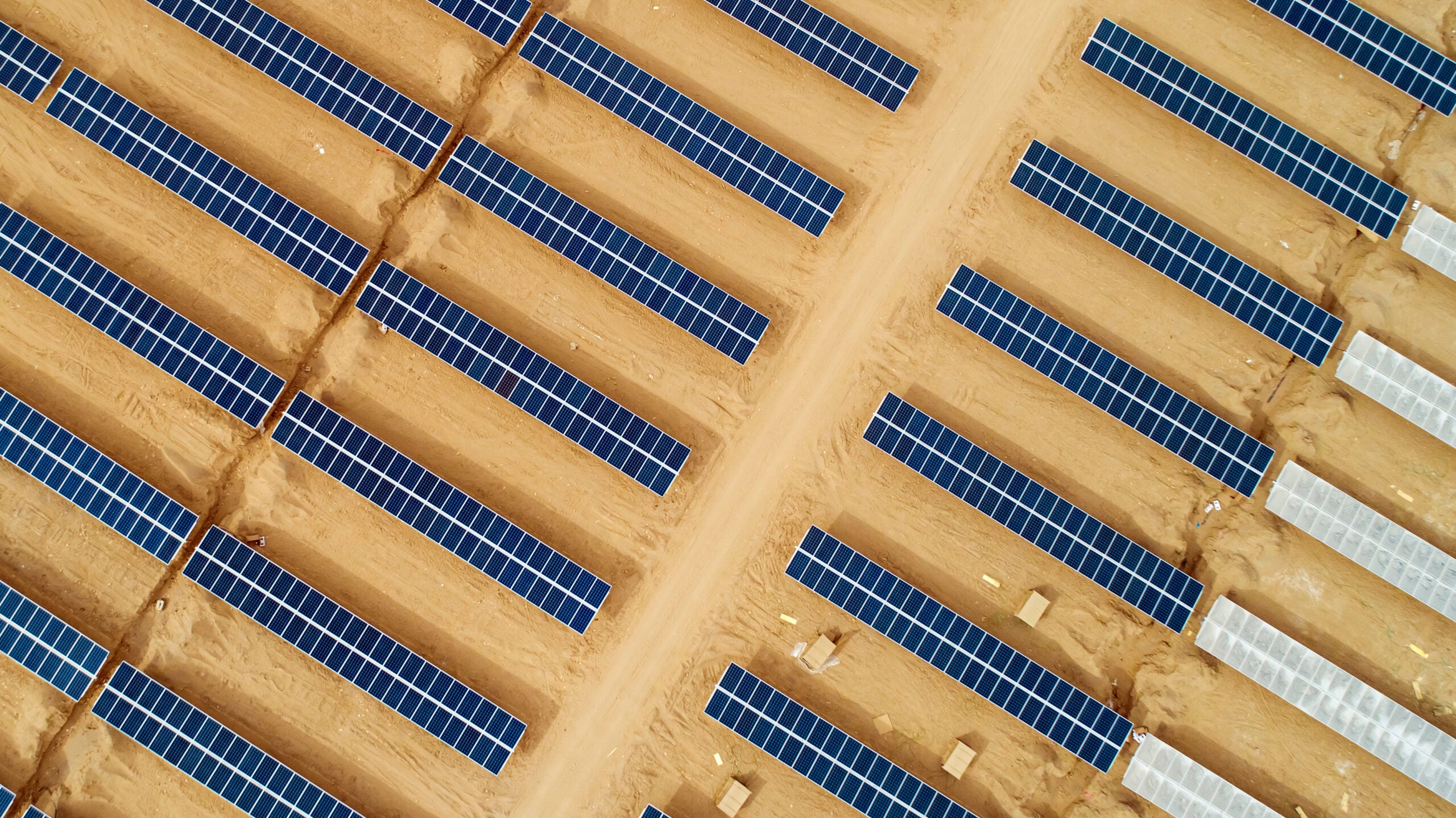

By GlobalDataTop solar panel manufacturers

Global solar photovoltaic module shipment ranking in 2018

Source: GlobalData, Power Intelligence Center

Note: The preliminary results are based on the initial assessment of the shipments and are subject to change later.

The global solar PV module market was valued at $32bn in 2018 and is estimated to reach $20bn, in 2022, registering a negative compound annual growth rate of 11.2% between 2018 and 2022. The fall in the market value was mainly due to the fall in module prices.

JinkoSolar reported a spectacular response in 2018, after the share crash on account of cuts in the Chinese market incentives. The company managed this decline and remained committed to the initial shipment guidance by expanding and supplying in overseas markets and today stands to benefits from the Chinese recovery and improved market demand.

JinkoSolar has shown great character in holding its leading position by managing supplies during a time when the Chinese government slashed some incentives. The core reason for the recovery is the diversification of their business in overseas markets, rather than limiting themselves to the local market.

Top 5: JunkoSolar, JA Solar, Trina Solar, Lerri Solar, Canadia Solar

JA Solar overtook Trina Solar to jump one spot up in the ranking. The company is in a strong position in the areas of product quality and reliability, performance, innovation, as well as robust financial management. JA Solar is eyeing the upcoming Middle East market with bifacial technology that has resulted in improved yield and resilience, particularly apt for the region.

As regards the other companies which made the top rankings, Trina Solar Limited and Lerri Solar Technology Co Ltd occupied third and fourth place, with shipments of 8.1 GW and 7.2 GW, respectively.

Canadian Solar came fifth with 6.4 GW, Hanwha Q CELLS Co, Ltd was sixth with 5.6 GW, Risen Energy Co, Ltd stood in seventh place with 4.8 GW, and GCL System Integration Technology Co, Ltd lay in eighth spot with 4.1 GW.

Lerri Solar Technology Co Ltd, a subsidiary of LONGi Green Energy Technology, has entered the top-five group. The company is planning to raise its stakes in the growing market through rapid expansion in domestic and overseas manufacturing facilities.

Risen Energy jumped three spots with a two-fold rise in the module shipments gaining a substantial competitive edge in technology, automation and cost control in the photovoltaic sector. For the past few years, the company has been expanding its presence in Italy, Germany, Romania and India.

Related Company Profiles

JA Solar GmbH

Trina Solar Co Ltd

JinkoSolar SAS

Lerri Solar Technology Co. Ltd.

JinkoSolar Holding Co Ltd