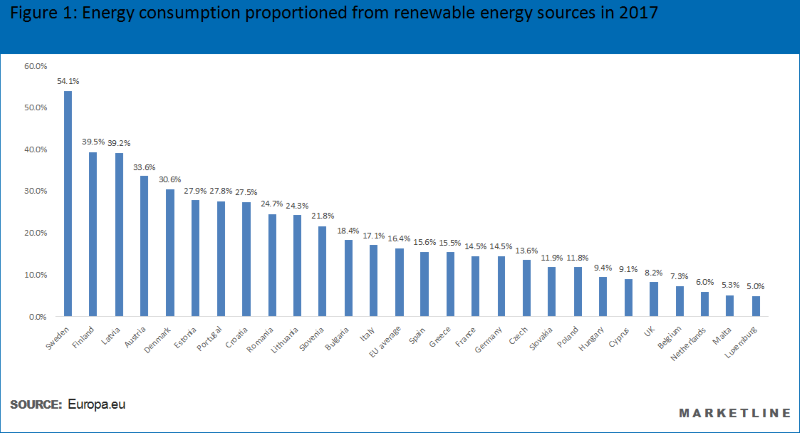

Ranked 24th out of 28, the UK is far behind other European Union economies when it comes to the consumption and production of renewable energy. It is clear that the priorities of the UK government have shifted away from importance of carbon-free energy sources somewhat.

Scrapping the tidal lagoon project in Swansea

After a decade of talk, the Tidal Lagoon Swansea Bay, if built, would have been the world’s first tidal lagoon power plant, and would have done wonders for renewable energy generation for the UK and Europe alike. It was announced on 25 June that the UK government did not wish to proceed with plans, after 18 months of analysis. The £1.3bn proposal apparently did not satisfy energy ministers, who said it would be too expensive to explore as an option.

Business secretary Greg Clarke had concluded that the potential of a lagoon like this would provide little potential for cost reductions and would limit economic benefit. The project would have been financed through household energy bills for decades to come and he claimed that offshore wind farms and further nuclear power plants were a better alternative.

However, the reasoning here is not good enough. This project, when completed, would have provided sufficient power for the whole of Wales and it would have been a tremendous load off the rest of the UK’s shoulders. Hinkley point (which was approved in 2016) is a power plant to be constructed in Somerset and is said to cost around £20bn – far more than the Swansea tidal lagoon plant. Additionally, once built the tidal lagoon would have a major strike price leaving it with the potential of selling on to major tech companies meaning the government could have easily made its money back on the project. It would have been a phenomenal tourist attraction that would have created thousands of jobs in Wales.

UK clean energy investment fell by 57% in 2017

Due to government policy changes, investment in clean energy plunged further in Britain than in any other country last year. The amount companies spent on green energy in the UK rose during the years of the coalition government (2010-2015) but this has now fallen for two years in a row under the Conservatives. While investment in wind, solar and other renewable sources slumped by 57% to £7.5bn ($10.3bn) in the UK, worldwide spending climbed 3% to £242.4bn ($333.5bn), the second-highest level on record. The UK is falling behind the global pace in this sector, and it needs to make drastic efforts to increase its focus on the renewables sector if it is to achieve future targets.

It seems the actions of the Conservative government are starting to speak louder than words. However, spending also fell in Germany, Japan, India, Norway, Turkey and Taiwan. The fall of 57% in the UK was the steepest decline, far out-stripping the decrease of 26% for Europe as a whole.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEnergy firm Npower’s parent company Innogy commented on the UK being a great place to invest, but there had been a stop-start approach from the government. This cyclic approach from the UK government seems to restrict investment from large energy firms such as Innogy, and may have held the UK back when it comes to increasing green energy consumption over recent years.

Energy consumption is only going to increase over the next 20 years

As technology becomes more advanced and electricity demands continue to increase worldwide, it is important for the UK to focus on the renewables sector now, while it has the time to build plants so it does not come across problems in the future. For example, regular fueled vehicles are due to be banned by 2040 and this will mean electric cars will be common on every corner. This will bump up electricity usage, so focus on renewable sources should be prioritised to facilitate this increase in energy demand in the coming years.

The UK’s power consumption fell nearly 2% from 355 terawatt hours to 348 tWh in 2017, while it rose across the EU as a whole by 0.7% from 3,239 to 3,262 tWh.

Over the past seven years, electricity demand in the UK has fallen by 7%. Perhaps this has given the government some comfort on energy demand trends, hence the lower investment in 2017. However, future needs should not be ignored and must be acted on now.