AES Gener, a subsidiary of AES Corporation, has agreed an early end to two power purchase agreements (PPAs) with the Angamos coal-fired plant in Chile.

558MW

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUnder the agreement the PPAs will be terminated early, during August next year.

AES president and CEO Andrés Gluski said: “As a result of this agreement, AES Gener is accelerating all future payments from two of its long-term coal generation contracts, for a total of $720m.

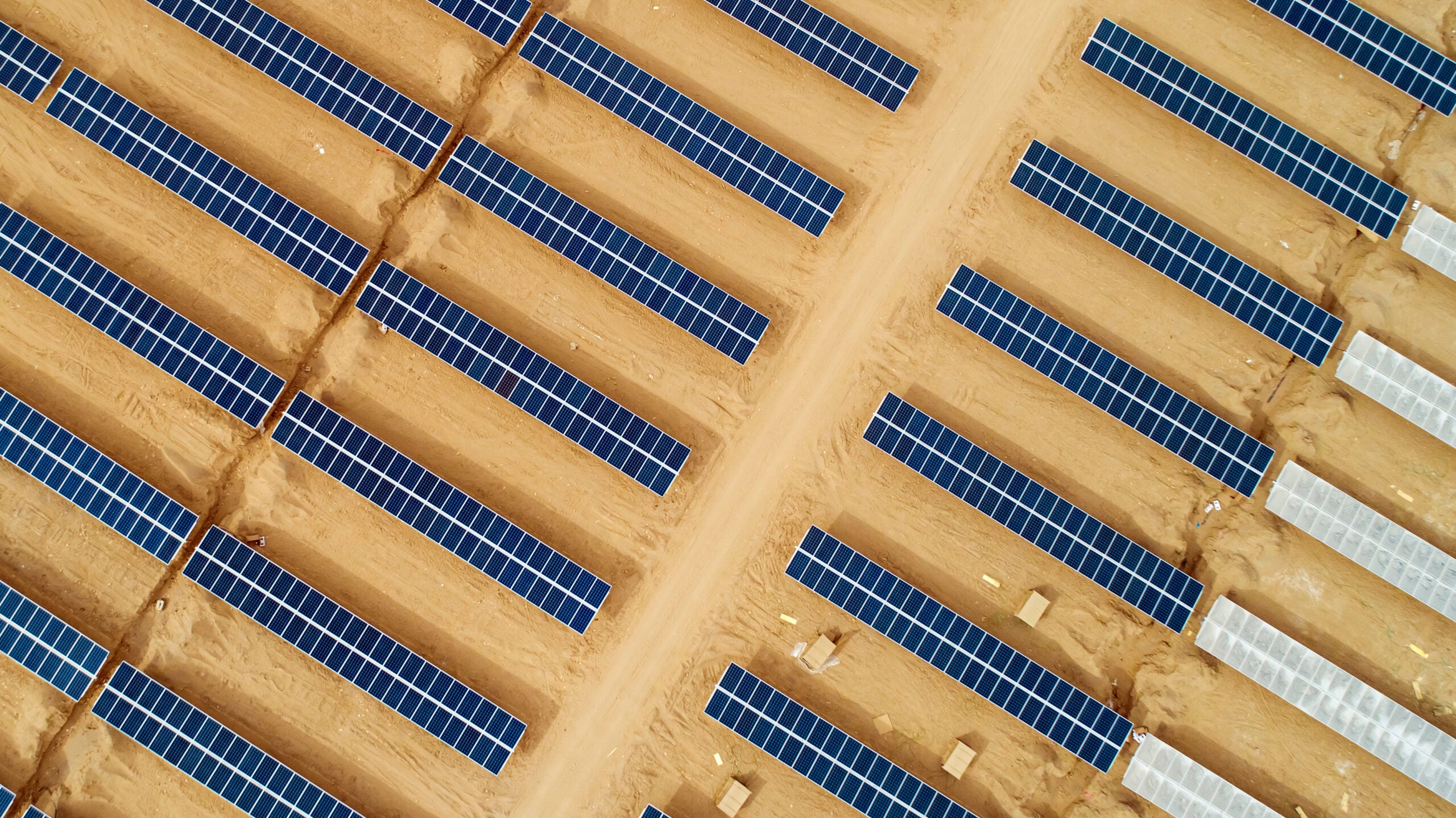

“This transaction also expedites the timeline of AES Gener’s decarbonization program, while providing additional funding for AES Gener’s current backlog of 2GW of renewable projects.”

The 558MW Angamos plant will receive a payment of $720m this year. This reflects the present value of fixed charges paid through to 2029, as agreed in the PPAs.

By 2022, the Angamos plant will no longer use PPAs. Once the national electricity system no longer requires the plant for reliability, AES Gener will close Angamos, after recovering its expected return and investment.

AES executive vice-president and chief financial officer Gustavo Pimenta said: “After paying down debt to strengthen its balance sheet and investment-grade ratings, AES Gener will use the remaining proceeds of approximately $200m to fund its renewable growth.

“This announcement demonstrates that the real value of AES Gener’s businesses is in its long-term contracts and customer relationships, as the company transforms its portfolio while delivering sustainable and growing earnings.”

Last month, AES Corporation agreed to sell its interest in the 295MW Itabo power plant in the Dominican Republic for approximately $101m. Dominican-based conglomerate Grupo Linda will buy the plant.

Completion of the agreement is subject to conditions.