The UK Government is set to announce the results of its contracts for difference (CfD) auction on 8 September, but no new offshore wind farms are expected to have bid for the contracts this year.

The CfD are a key incentive to ensure renewables investment for the UK. They reduce costs for developers and ensure financial security by guaranteeing that customers pay a fixed price for electricity.

However, industry support for the UK’s offshore wind industry is waning. Major players have been warning that incentives no longer account for rising inflation and increased operational costs. Developers say that supply chain costs have seen an inflation rate of 40%.

In July, Swedish energy major Vattenfall announced that it was halting development on a 1.4GW wind farm in the North Sea citing rising costs and “challenging market conditions”.

The UK Government has an ambitious target in place to triple its offshore wind capacity to reach 50GW by 2030.

Insufficient support for UK offshore wind industry

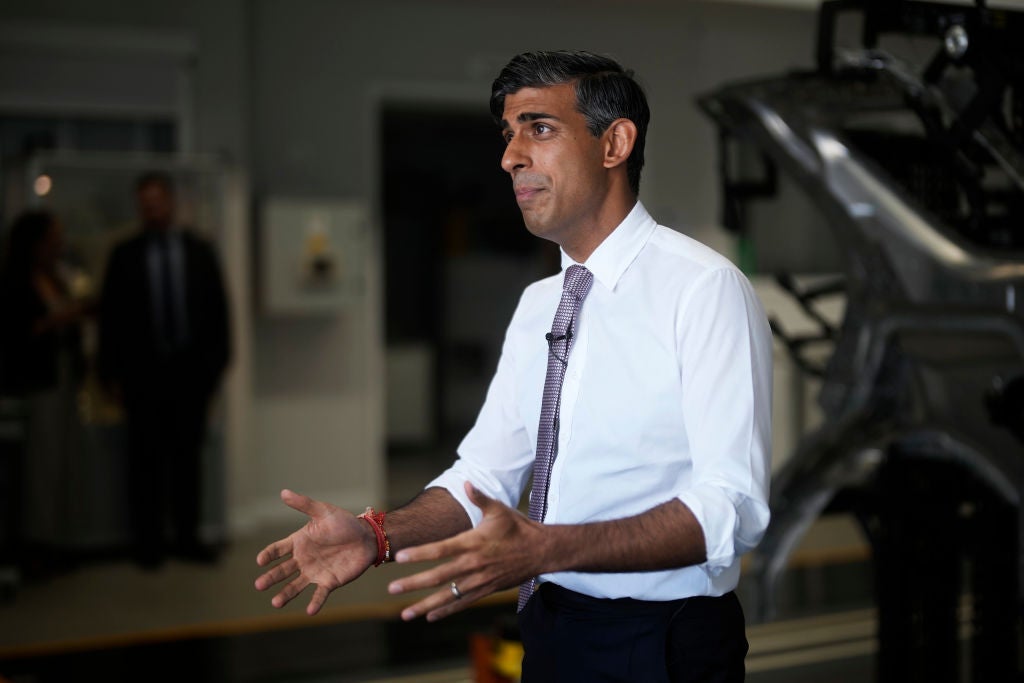

The speculation comes as UK Prime Minister Rishi Sunak called off a major meeting with green energy bosses that was scheduled for later this week.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMultiple industry sources told UK newspaper the Times that the auction had failed to secure any offshore wind developers as ministers ignored complaints that the support on offer is not sufficient.

Five offshore wind developments with a combined capacity of 5GW were eligible for this year’s auction. All three developers, Vattenfall, ScottishPower and SSE, have previously spoken out about the impacts of rising inflation on the industry.

“It will be a huge knock to investor confidence on Thursday if the auction turns out to be as deeply unsuccessful as everyone thinks it is going to be,” Nathan Bennett, head of public affairs at trade association RenewableUK, told Politico.

Despite declining to increase the maximum price on offer under the CfD scheme, the UK Government has shown support for the North Sea fossil fuel industry. Sunak recently announced plans to approve “at least 100” North Sea oil and gas licences, prompting criticism from the renewables industry, political opponents and environmentalists.

The CfD scheme makes £227m ($283m) of support available for renewables developers. Aside from offshore wind, other projects including solar and tidal may prove more successful.

A spokesperson from the Department for Energy Security and Net Zero told reporters that it “remains committed to further increasing our use of renewables, including offshore wind, to meet our net-zero targets and decarbonise our electricity sector by 2035”.