The growing demand for electricity, climate change concerns, and technology development are some of the major factors influencing the gas turbine market.

Evolving manufacturing practices are contributing to the fabrication of new thermal-based power generation systems with reduced environmental pollution to enhance market acceptance.

Various new technologies developed over the past decade, such as Integrated Gasification and Combined-Cycle (IGCC), carbon capture and storage (CCS), supercritical and ultra-critical power generation, and carbon sequestration, are far cleaner and make thermal power generation more acceptable within the confines of established policies and regulations.

These technologies will go a long way in helping gas turbine companies to continue operations, particularly gas turbine manufacturers. It is likely that the demand for gas turbines will outpace that for steam turbines, as the former is more technologically advanced and efficient, with low environmental impact.

Addressing Global Warming with Gas Turbines in the Power Generation Industry

Addressing global warming and other harmful environmental effects has become a priority for countries around the world. These concerns have led many countries in the region to adopt stringent emission norms and promote the use of cleaner sources of power generation.

Under these circumstances, natural gas is expected to become a strong competitor to coal. Factors such as increasing focus on advances in gas turbines in order to raise efficiency and the development of high-temperature materials for turbines influence the dynamics of the gas turbine industry.

Global Gas Turbine Market Forecast: Growth Projections from 2019 to 2026

The global gas turbine market was estimated at 29.9GW in 2019 and is projected to reach 32.2GW in 2026. Countries such as the US, China, and the UK, will drive growth in the gas turbine market.

Top Gas Turbine Manufacturers: Market Share and Industry Consolidation

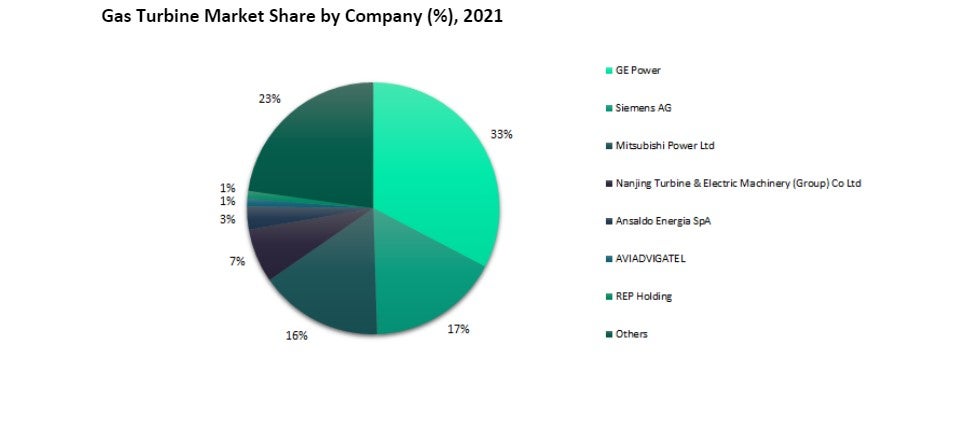

Consolidation in the global gas turbine market is greater than that in the steam turbine market. Gas turbine manufacturers GE Power, Siemens AG, Mitsubishi Power Ltd, Nanjing Turbine & Electric Machinery (Group) Co Ltd, Ansaldo Energia SpA, AVIADVIGATEL, and REP Holding together accounted for 78% of the market in 2021.

Leading Gas Turbine Companies: Key Players in the Global Market

Other significant gas turbine companies include MAPNA Group, Siemens Energy AG, Bharat Heavy Electricals Ltd, Power Machines, Caterpillar Inc, Shanghai Electric Group Corp, Raytheon Technologies Corp, Harbin Electric Corp, Gazprom, and Doosan Enerbility Co Ltd.

Source: Gas Turbines

Finding the best gas turbine supplier

Power Technology has listed leading manufacturers of gas turbines based on both its experience in the sector and research carried out by GlobalData.

The information contained within the download document is designed for production managers, procurement managers, maintenance managers, quality control managers, marketing managers, research & development managers, and supply chain managers, and the many other roles responsible for the purchase of gas turbines.

The free Buyers Guide is available to download and contains detailed information on the suppliers and their product lines, alongside contact details to aid your purchasing decision.

FAQs

What is the role of gas turbines in power generation?

Gas turbines play a critical role in power generation, converting natural gas or other fuels into mechanical energy, which drives electrical generators. Their ability to generate electricity quickly, with higher efficiency and lower emissions compared to coal-based systems, makes them essential in both standalone and combined-cycle power plants.

How do gas turbines contribute to cleaner energy?

Gas turbines are cleaner than traditional fossil-fuel-based systems. By integrating with advanced technologies like carbon capture and storage (CCS) and using high-temperature materials, they reduce greenhouse gas emissions and increase thermal efficiency, helping meet global climate goals.

What is combined-cycle gas turbine technology?

Combined-cycle gas turbines (CCGT) combine gas turbines with steam turbines, utilising exhaust heat from the gas turbine to generate additional electricity through a steam turbine. This configuration increases overall power plant efficiency, often reaching up to 60% compared to simpler configurations.

How do gas turbines support energy transition?

Gas turbines support the global energy transition by facilitating the integration of renewables. Due to their quick-start capability, they provide flexible backup power for intermittent renewable sources like solar and wind, helping to stabilise grids.

Who are the leading companies in the gas turbine industry?

Leading gas turbine companies include GE Power, Siemens Energy, Mitsubishi Power, and Ansaldo Energia. These companies specialise in producing high-efficiency gas turbines for various applications, from large-scale power plants to industrial facilities, and continue to innovate with cleaner and more efficient technologies.

Note: GlobalData, the leading provider of industry intelligence, is the parent company of Power-Technology.com and provided the underlying data, research, and analysis used to produce this article.