Offshore renewable companies in Europe have warned that the industry does not currently have the capacity to meet net-zero targets. The joint statement calls for greater policy support from European governments.

The call from more than 100 companies coincides with the meeting of leaders from nine countries at the North Sea Summit, where they will implement new targets for offshore wind in the North Sea.

According to the statement, the offshore renewable industry in Europe is “not large enough today to deliver the nine governments’ commitments and meet the rising demand for renewable electricity and renewable hydrogen”.

Companies that have signed the statement include BP, EDF, Equinor, Britain’s National Grid, Nel, Ørsted, Shell, Siemens Gamesa, Vattenfall and Wind Europe.

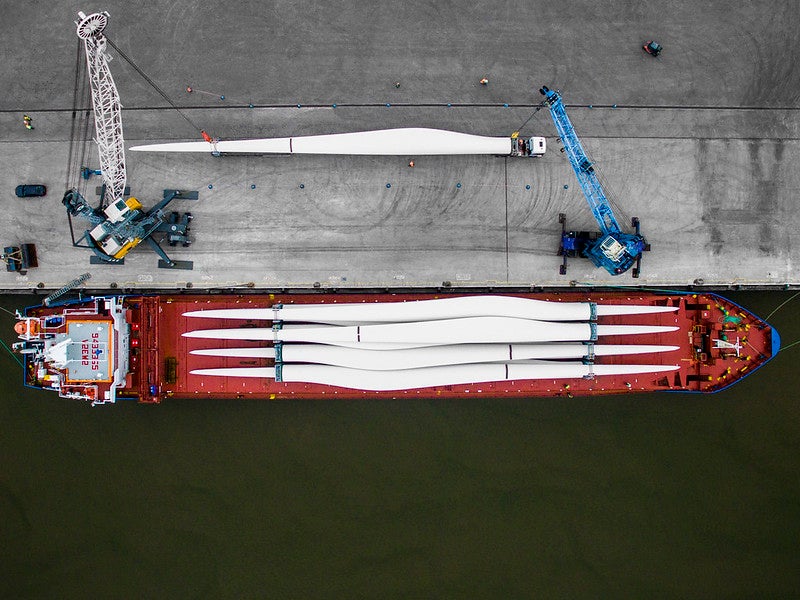

The signatories maintain that “huge investment” is needed across the length of the supply chain to expand to the required level.

In the statement, the companies call on the EU to offer financial support “using unspent resources via e.g. the Sovereignty and Innovation Funds. The EU should avoid linking this to only technology breakthroughs. Expanding the offshore wind value chain is primarily a volume challenge.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Massively ramp up European wind supply chains”

Sven Utermöhlen, WindEurope chair and CEO of RWE Offshore Wind, said: “For achieving the ambitious offshore wind buildout targets, we need to massively ramp up European wind supply chains by target industrial policy measures and adequate support instruments. This needs to be complemented by auction designs fit-for-purpose, taking into account inflation developments for increasing the investment certainty of both manufacturers and developers and thereby allowing the lowest financing cost.”

Last year investment into offshore wind plummeted among rising installation costs, inflation, higher interest rates and increased seabed leasing fees. Additional factors included volatility in the energy market resulting from the European energy crisis and the Russian invasion of Ukraine influencing demand and pricing.

According to the companies’ “industrial statement” more than 20GW of offshore wind capacity will need to be added annually to meet 2030 and 2050 net-zero targets.

The group warned the EU against extending its cap on power generators’ revenues, which is due to expire in June. The scheme, agreed at the end of September, sought to “collect and redistribute the energy sector’s surplus revenues to final customers” amid record high revenues. The industry, however, warned that it deterred investors.