President Donald Trump’s return to the White House in January 2025 marked a decisive shift in energy policy for the US. Climate ambition has been deprioritised in favour of speed, reliability and national security, with energy recast as a strategic asset underpinning industrial competitiveness and geopolitical leverage.

As a result, the power sector has been pulled in different directions: record demand growth colliding with trade barriers, and fossil fuel support rubbing up against entrenched clean energy economics.

At the heart of this shift are data centres. Trump has been unequivocal about expanding domestic digital infrastructure, and this ambition has rippled across energy policy.

“In his executive orders (EOs) on data centre expansion, he treats energy as a core asset,” says James Roth, head of government affairs and policy at Bloom Energy and former director in the Executive Office of the President under the Clinton and Bush administrations. “When the White House issues that kind of edict, from my experience, it sends a clear signal to federal and state regulators to enact policies or regulations consistent with that.”

Simultaneously, tariffs have been the most consequential – and disruptive – policy tool of Trump’s second term. By the end of his first year, average effective US tariff rates had climbed to around 15% year-on-year (YoY), reaching levels not seen in decades. Key equipment and components for generation, transmission and distribution have been caught in the crossfire, driving up project costs and heightening uncertainty. According to Power Technology’s parent company, GlobalData, tariff-related job postings in the power sector surged 657% YoY in 2025, reflecting the scale of disruption across the industry.

Amid the chaos, power demand growth has proved relentless, forcing utilities, developers and investors to adapt, regardless of Washington’s priorities.

Trump tariffs and power, a summary

Trump returned to office guns-blazing; early on, he targeted Chinese goods, including renewable energy components, with tariff rates as high as 60%, before extending duties to other key trading partners like South East Asia and Europe. In June 2025, steel and aluminium tariffs doubled to 50%, while a new 50% tariff on copper took effect in August. These materials underpin every part of the power system, including but not limited to, turbine towers, solar frames transformers and transmission lines.

“While the US’ goal [from the tariffs] is to stimulate domestic manufacturing, the immediate effect has been a disruption of established supply chains and higher prices for essential components and materials for US energy,” explains Pavan Vyakaranam, senior power analyst at GlobalData.

GlobalData analysis estimates that Trump’s tariffs on steel, aluminium and copper increased overall project costs for US power generation assets by 6–11%. While solar and battery storage have been hit hardest, other assets – including those favoured by Trump, like gas plants – were also ensnared in collateral damage.

The new economics of power: how has Trump 2.0 affected each technology?

Nuclear power

Nuclear power has been one of the clearest beneficiaries of Trump’s second term. The administration has framed it as a cornerstone of energy dominance, national security and data centre expansion.

In May 2025, Trump set a target to quadruple US nuclear capacity to around 600GW by 2050. He then followed up with multiple EOs aimed at reinvigorating the nuclear industrial base, reforming reactor testing and reshaping the Nuclear Regulatory Commission to accelerate approvals.

“At first glance, Trump's approach might seem just domestic-focused and less international [than other administrations], but there has also been a lot of bilateral cooperation,” World Nuclear Association representative Henry Preston clarifies. In 2025, the US established agreements with the likes of South Korea, Japan and the UK on advanced fuels, reactor designs and heavy-component manufacturing. Most notably, in October, the US Government partnered with the Canadian owners of Westinghouse Electric to develop new nuclear reactors, with a projected investment of $80bn.

Preston notes that nuclear’s resurgence is not a sharp break from previous policy. Under the Biden administration, the Inflation Reduction Act (IRA) delivered significant support for nuclear, and the US led international coordination on the COP pledge to triple global nuclear capacity.

“Trump’s approach has been a different mechanism – primarily executive orders,” he says, “but overall, I think it is more of a continuation, just with a different emphasis and delivery.”

What has changed dramatically since Trump’s first term is demand. AI and data centres have spotlighted nuclear more than ever, given their compatibilities in load profiles. “We are now seeing groundwork for small modular reactors across the US and major investment in advanced fuels,” Preston adds.

Rising demand, energy security and reliability – “those three factors are really driving support for nuclear”, he says, and they are unlikely to fade regardless of who occupies the White House. “The [continuation of] bipartisan support for nuclear in the US will be crucial, because nuclear is a long-term asset.”

Thermal power: gas and coal

If nuclear represents long-term ambition, natural gas and coal have been the short-term workhorse of Trump’s energy agenda.

“Trump’s speed-focused energy approach centres around expediting the permitting and approval timelines for energy infrastructure – especially oil, natural gas and coal projects – by streamlining environmental reviews and reducing regulatory friction,” says Vyakaranam.

In 2025, Trump has solidified federal backing for new combined-cycle plants, issued EOs to streamline permitting, accelerated approvals under National Environmental Policy Act revisions, and instructed the Federal Energy Regulatory Commission to facilitate approvals for new pipelines and LNG capacity, all as part of his “energy dominance” agenda.

The president’s enthusiasm for data centres has further strengthened gas’ position, with Vyakaranam noting: “With Trump’s pro-fossil fuel policies in place, it is both more economical and, from a clearances perspective, easier to roll out gas-based projects than others like renewables for data centres.”

Karen Wayland, CEO of the GridWise Alliance, adds that coal power has seen similar support, with the administration pushing to keep large conventional generating resources online, including rolling back Clean Air Act rules for coal plants and issuing emergency orders to delay retirements.

The favouritism is even clearer with the thermal sector’s tariff exemptions; none of Trump’s tariffs have been applied to crude oil, natural gas or refined fuel imports, with the purpose of safeguarding the feedstock imports on which most of the Gulf Coast’s refineries rely to produce US petroleum products.

However, fossil developers still rely on steel, aluminium and copper imports – all subject to tariffs. Therefore, “although Trump’s policies promote the advancement of fossil fuels, his tariffs on key materials have raised the cost of pipelines, compressors and plant equipment”, says Vyakaranam, adding that the resulting higher construction and maintenance costs risk feeding into consumer electricity prices.

Renewable power: solar, wind and hydro

Clean energy developers braced for turbulence as soon as Trump’s victory was announced in 2024.

As anticipated, the first year of Trump’s second term saw federal support weaken. The One Big Beautiful Bill Act (OBBBA) accelerated the end of eligibility for clean electricity production and investment tax credits; the Department of Energy’s grant programmes have been scaled back; offshore wind leasing paused; and national clean electricity targets effectively shelved, with deployment now driven largely by state mandates.

According to GlobalData, clean energy project cancellations reached around $8bn in the first quarter of 2025 alone.

Solar revealed multiple contradictions in Trump-era energy policy. Globally, module oversupply has driven costs down; yet in the US, tariffs and anti-dumping duties have pushed costs back up over the past year. GlobalData estimates Trump’s tariffs to have raised US utility-scale solar project costs by around 20–54%, under different scenarios, driven by a spike in imported module and inverter prices.

While domestic manufacturing has grown, Vyakaranam notes that the US still lacks upstream scale, extending procurement lead times and limiting the domestic sector’s ability to absorb tariff shocks.

The wind power sector – especially offshore – has faced the most direct backlash. On his first day back, Trump signed a memorandum pausing all new or renewed leasing and permitting for wind projects. Over the course of the year, his administration issued stop-orders on several large-scale offshore projects, rescinded $679m in grants for wind energy infrastructure, and launched investigations into “national security risks” of wind projects and imported wind components, among other actions.

The President’s long-standing hostility culminated in December with the suspension of five major offshore projects on the grounds of national security. Although relevant developers quickly retaliated with legal proceedings, the move had already triggered a sharp sell-off.

Tariffs were an additional layer to the damage. The price hike on imported steel and aluminium – integral to wind turbines – has significantly driven up project costs. Dominion Energy’s 2.6GW Coastal Virginia project, for instance, reported an estimated capital cost rise from $10.9bn to $11.2bn resulting from tariffs.

While onshore wind has been shielded by Trump’s policy shifts relative to offshore, this was not the case for his tariffs. Vyakaranam estimates that tariffs may raise US onshore wind capital expenditures by up to 9% and increase the subsidised levelised cost of energy by 2–11% across different scenarios.

“The direct impact of tariffs encompasses elevated input expenses, whereas indirect consequences arise from disturbances to the equilibrium of supply and demand within intricate international supply chains.”

The Trump administration’s policies point to increased uncertainty, project delays and rising costs for the US solar and wind industries – thereby reducing competitiveness against fossil fuels.

Yet, experts argue that these rollbacks have not fundamentally changed the trajectory for US renewable energy.

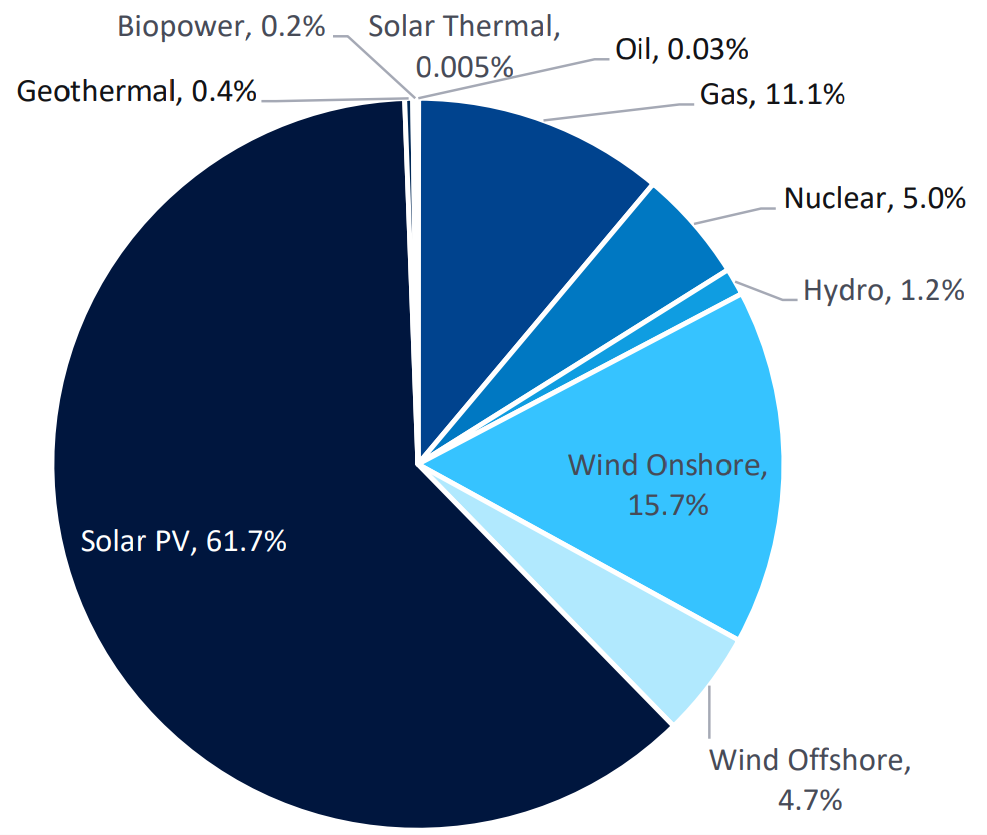

Despite the policy headwinds of 2025, renewables continued to flourish, buoyed by the underlying economics – with wind and solar among the cheapest new power sources – and "deeply entrenched long-term policy frameworks like the IRA", says Vyakaranam. The outlook remains strong, with GlobalData projecting that solar photovoltaic will account for 61.7% of investments in the power market between 2025 and 2030.

“Some projects in development might have been slowed because of loss of tax incentives or other policy setbacks, but the reality is, because of the growing cost differential between renewables and conventional fossil fuel generating resources, utilities are likely to keep adding renewable energy,” Wayland confirms.

Meanwhile, hydropower stood out as a renewable technology favoured by Trump. The administration has explicitly prioritised hydropower development as part of its America First energy policy, recognising its role in grid reliability and energy independence.

The OBBBA also includes provisions favourable to hydropower, with tax credits retained for hydropower projects starting construction by the end of 2033. The bill also includes workable Foreign Entity of Concern provisions relevant to hydro and pumped storage supply chains.

Energy storage

While generation policy has dominated headlines, the real constraint of the power sector in 2025 has been delivery. Data centres alone drove a more than 20% increase in US grid power needs, according to GlobalData, while the country’s interconnection queues swelled to more than 2.6TW of planned capacity.

Against this backdrop, energy storage has emerged as one of the most resilient technologies under Trump. While renewable tax credits were rolled back, those for stand-alone storage remain intact through the mid-2030s.

“Storage was largely spared [from negative effects of Trump’s policies],” says CEO of Fourth Power Arvin Ganesan, mainly due data centres. Current grids are proving incapable of handling the demands of these energy-intensive facilities; storage serves as an appealing solution, as it allows for “power delivery when the centre needs it”.

“More fundamentally, battery facilities can be built in roughly two years, far faster than large-scale generation or transmission upgrades,” he adds.

However, the energy storage market, too, was not immune to tariff impacts. Given China’s dominance over the lithium-ion used in battery production, alongside tariffs on other key storage materials like copper and aluminium, Trump’s trade policies have “significantly increased the cost of energy storage systems and project development, hindering further investment”, Vyakaranam explains. GlobalData projects costs for US grid-scale battery system to have increased 12–50% as a result of tariffs.

Still, Ganesan believes that “despite these short-term impacts, storage will continue to grow in the US”. GlobalData analysis supports this outlook, with US battery storage, having surpassed 40GW in operational capacity in 2025 despite tariff repercussions, set to be the country's fastest growing grid resource in the next decade.