Hydropower capacity in the US is expected to remain largely flat through 2035 as pumped storage projects emerge as the main source of sector growth, according to GlobalData’s US Power Outlook, Update 2025.

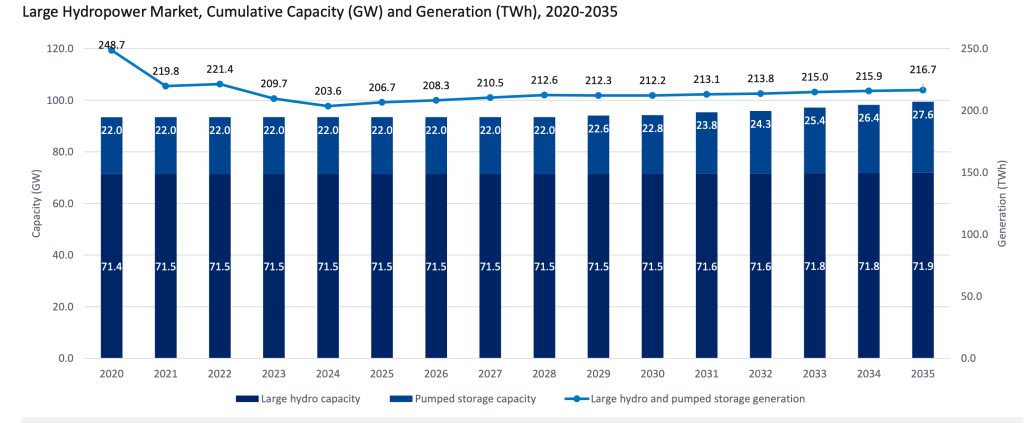

Large conventional hydropower capacity increased only marginally from 71.4GW in 2020 to 71.5GW in 2024 and is projected to reach just under 72GW by 2035.

In contrast, pumped storage capacity is forecast to rise from 22GW in 2024 to 27.6GW by 2035, reflecting renewed interest in long-duration energy storage to support expanding solar and wind generation.

Hydropower generation declined from 248.7 terawatt-hours (TWh) in 2020 to 203.6TWh in 2024, driven primarily by hydrological variability. Output is expected to recover gradually, with combined large hydro and pumped storage generation projected to reach 216.7TWh by 2035, representing a compound annual growth rate of 0.6% over the forecast period.

Federal policy is increasingly focused on asset modernisation rather than new large dam construction. The report highlights life-extension programmes, turbine upgrades and digital control systems as priority areas for maintaining fleet performance and improving operational flexibility. These upgrades are aimed at enhancing grid reliability as variable renewable generation expands.

The project development pipeline reflects this shift towards storage-led growth. More than 9GW of hydropower capacity has been announced for the 2025–35 period, dominated by pumped storage proposals in the western US. Major projects in development include the 1.2GW Goldendale pumped storage project in Washington, the 1.3GW Eagle Mountain project in California and the 2GW Intermountain pumped storage project in Utah.

Despite this momentum, hydropower’s share of total generation is expected to gradually decline as solar and wind expand at faster rates. By 2035, large hydropower and pumped storage are forecast to account for approximately 3.9% of US electricity generation, down from 4.5% in 2024.

Industry analysts note that pumped storage is becoming increasingly important as a system balancing asset, providing multi-hour energy shifting and grid stability services that batteries alone cannot deliver at scale. As transmission bottlenecks and interconnection backlogs continue to slow renewable deployment, hydropower storage projects are positioned to play a larger operational role in the evolving US power mix.

You can purchase the full report at: https://www.globaldata.com/store/report/usa-power-market-analysis/.